The Surprising Benefits of Homeownership Beyond Finances

Last Updated on May 22, 2025 by Patricia Omishakin

When we talk about homeownership, the financial advantages often take center stage. However, owning a home comes with far more benefits than just building equity and saving on rent. Let’s dive into some of the life-enhancing perks of being a homeowner.

Freedom to Have Pets Without Restrictions

One of the greatest joys of owning a home is saying goodbye to pet restrictions and hefty fees. Forget sneaking your dog out during your landlord’s visits or worrying about losing your security deposit due to pet damage. When you own your home, you set the rules. From building the ultimate pet-friendly backyard to welcoming as many furry friends as you like, the freedom is entirely yours.

Personalize Your Space to Reflect Your Style

Owning your home gives you the creative freedom to design and decorate however you want. Say goodbye to the frustration of rental limitations like bland white walls or outdated fixtures. Want to paint your living room in bold colors, install new flooring, or create your dream kitchen? Go for it! Homeownership allows you to customize your space without limitations.

Enjoy Privacy and Security

Homeownership means no more thin walls or upstairs neighbors rearranging furniture in the middle of the night. A home of your own provides a sense of privacy and security, offering peace of mind that allows you to relax and truly unwind. The ability to create a private and secure environment is just one of the ways homeownership triumphs over the disadvantages of renting.

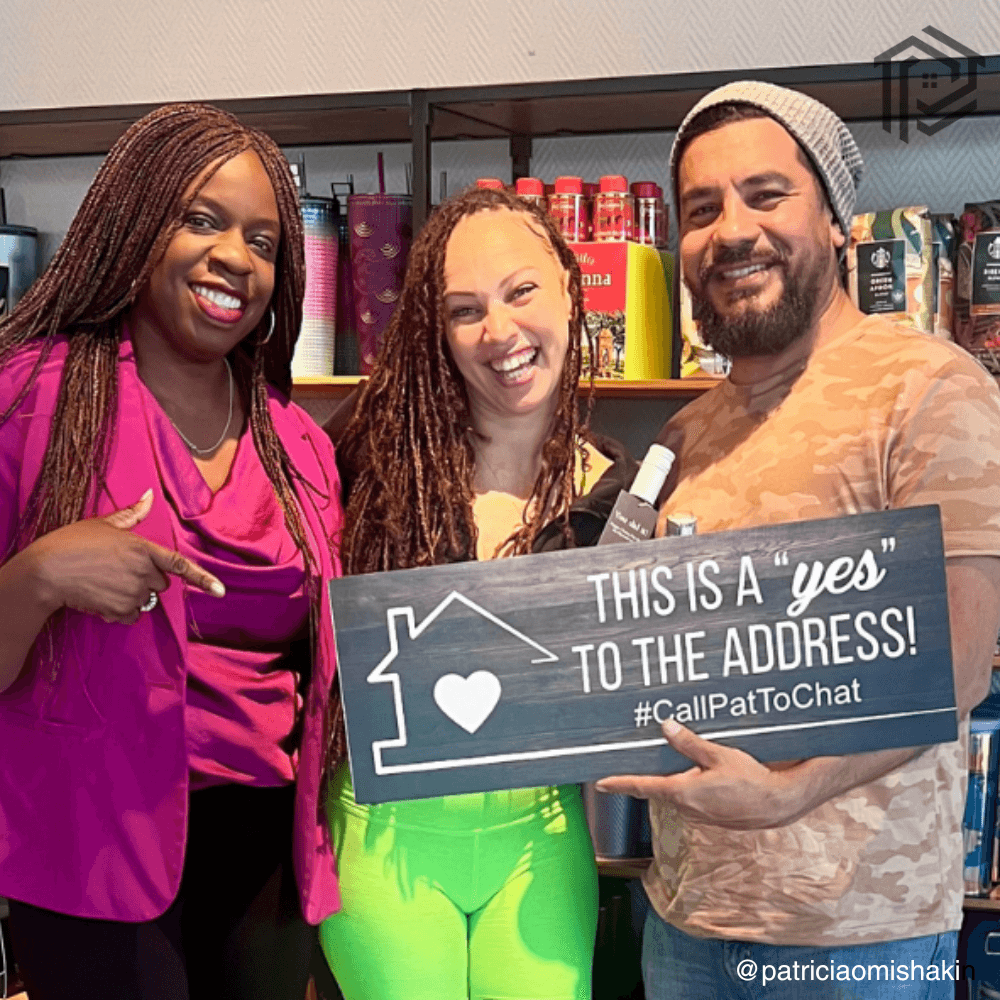

Build Community and Feel Connected

When you buy a home, you’re not just investing in property—you’re investing in a community. Homeownership often fosters stronger relationships with neighbors. You’ll find yourself attending neighborhood events, exchanging holiday treats, or borrowing that cup of sugar. Over time, these connections turn a neighborhood into a community and a house into a home.

Take the First Step Toward Homeownership

While renting may seem convenient, the disadvantages of renting—such as restrictions on pets, lack of privacy, and minimal creative control—make homeownership a more rewarding and fulfilling option. Beyond the financial benefits, owning a home allows you to create a space where you can truly thrive, build relationships, and express your individuality.

If you’re ready to experience the life-changing benefits of owning a home, let’s get started.

- Schedule a Strategy Session Here to discuss your goals and make a plan tailored to your needs.

- Not ready yet? Explore my Renter to Buyer in 90 Days Program and see how I can help you transition to homeownership step by step.

FAQs About Transitioning from Renting to Homeownership

1. Is owning a home really more affordable than renting?

It depends on your location and financial situation, but in many cases, owning a home can be more cost-effective in the long run. Unlike rent, which can increase over time, your monthly mortgage payment stays consistent (if you have a fixed-rate loan). Plus, homeownership builds equity, which can contribute to your overall wealth.

2. What are the disadvantages of renting compared to owning?

Renting often comes with restrictions, such as limits on pets, inability to customize your living space, and lack of long-term financial benefits. Additionally, rental costs can increase annually, while homeownership offers stability and the opportunity to build equity.

3. What upfront costs should I expect when buying a home?

When purchasing a home, you’ll need to budget for a down payment, closing costs, and possibly moving expenses. Additionally, you should plan for a home inspection, which helps identify any potential issues with the property. Depending on the house, you may need other specialized inspections (e.g., termite, radon, or structural). If you’re getting a mortgage, you’ll also need to pay for an appraisal to confirm the home’s value. Don’t forget about the earnest money deposit, which shows sellers you’re serious about your offer. Many first-time buyers are eligible for programs that reduce the required down payment or offer assistance with other costs, helping to make the process more affordable.

4. How can I prepare to buy a home if I’m currently renting?

The best way to prepare is to:

- Review your finances, including your credit score and savings.

- Learn about your loan options.

- Work with a real estate professional to understand the market.

- Join a program like my Renter to Buyer in 90 Days to get step-by-step guidance.

5. What’s the first step to becoming a homeowner?

The first step is to schedule a strategy session with a trusted real estate professional to discuss your goals, finances, and timeline.