How a Self-Employed Couple Said ‘Yes’ to Their Dream Home

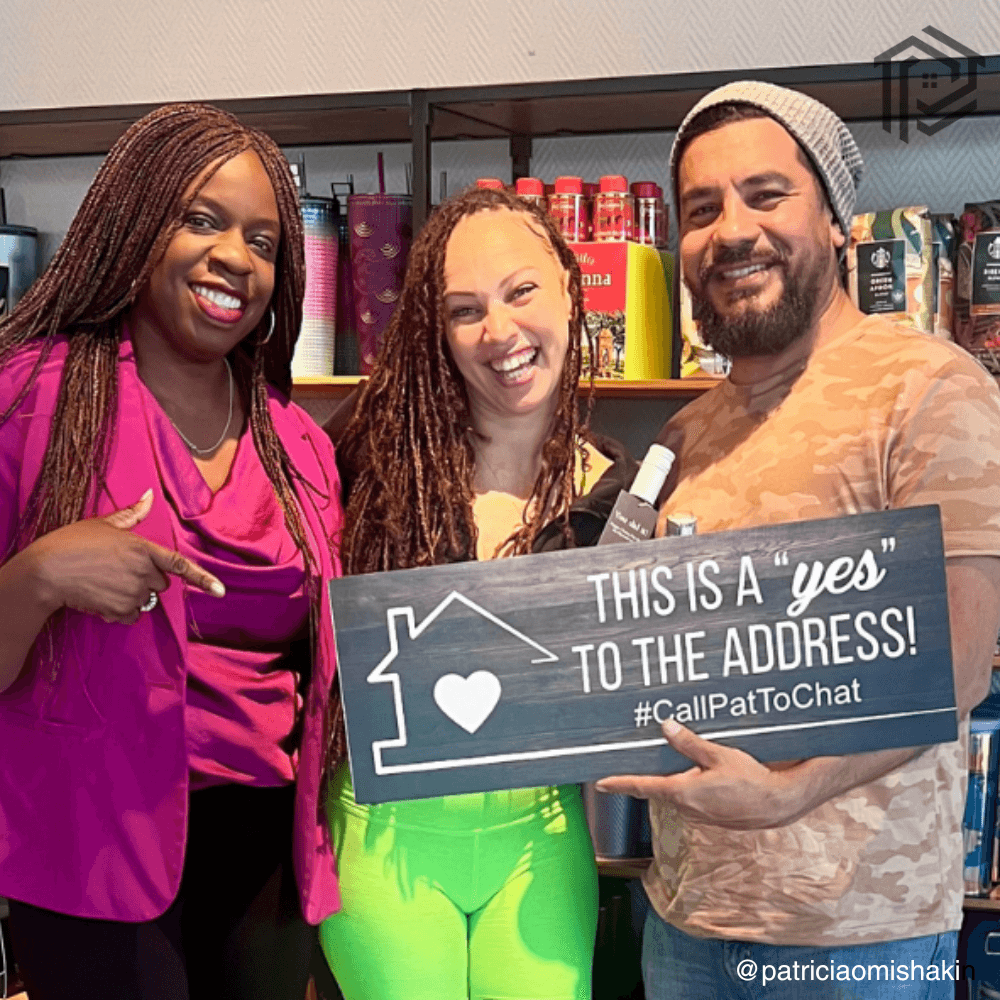

Meeting the Dreamers

Let me tell you about an amazing couple I met at a housewarming party last December. Their journey is the perfect example of how a self-employed couple said ‘yes’ to their dream home. They had a big goal—to own a home of their own. Like many people, they weren’t sure if it was possible, especially being self-employed. But with determination, smart planning, and the right support, they turned their dream into reality.

Starting with Preapproval

The first step in their journey was getting preapproved for a mortgage. For self-employed buyers, this can feel like a mountain to climb since it involves pulling together a lot of financial paperwork. But by March, they were preapproved by Lending Hand Mortgage. With that green light, they were ready to start their home search with confidence.

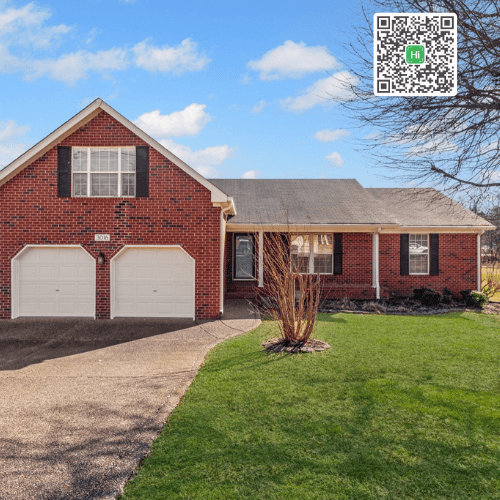

The Excitement of House Hunting

House hunting can take weeks—or even months. But for this couple, it was love at first sight. On the very first day of their search, they found a home that checked all the boxes. It was like the house was waiting for them. This kind of instant connection doesn’t happen often, but when it does, you just know.

Making the Right Offer

Finding the perfect home is one thing, but getting it is a whole different ballgame. With my help, they put in an offer that was $10,000 below the asking price—and guess what? We also negotiated $4,000 worth of home equipment to be included. Talk about a win-win! These smart moves helped them save money and add value to their new home right away.

Closing the Deal

Once the offer was accepted, things moved quickly. The closing date was set just three weeks away, so everything had to fall into place fast. Thanks to a smooth inspection and appraisal process, we hit every milestone right on time. Closing can be nerve-wracking, but preparation and teamwork made it a breeze.

A Step Toward Generational Wealth

For this couple, buying their first home wasn’t just about finding a place to live—it was about building a foundation for the future. Homeownership is a powerful way to create stability and even pass wealth down to the next generation. It’s an investment that pays off in more ways than one.

A Big Thank You to the Team

Of course, none of this would’ve been possible without the fantastic people at Lending Hand Mortgage and Hywater Title. Their expertise and dedication were key to making the process as smooth as possible. Huge thanks to both teams!

Hear It from Them

Your Turn: Make It Happen

Are you self-employed and wondering if you can buy a home? You absolutely can! This couple’s story proves that it’s possible with the right guidance. If you’re ready to stop renting and start owning, let’s chat. Sign up for my free 90 Days to Homeownership class and take the first step toward holding the keys to your dream home. Let’s make it happen!

FAQs

How important is preapproval for self-employed buyers?

Preapproval demonstrates your financial stability and readiness to purchase, particularly critical for self-employed individuals who may have fluctuating incomes.

What challenges do self-employed individuals face when buying a home?

The main challenges include providing extensive financial documentation and proving consistent income, but with proper preparation, these can be managed effectively.

What are the benefits of negotiating during the home buying process?

Negotiating can reduce costs, add value to your purchase, and help include additional benefits like essential home equipment.

How long does the closing process typically take?

Closing times vary but are often between 30-45 days. In this story, the process was completed in just three weeks thanks to thorough preparation.

Is it possible to buy a home as a first-time buyer while self-employed?

Absolutely! With the right mortgage lender and financial preparation, self-employed individuals can successfully purchase their first home.

Why is homeownership important for building generational wealth?

Owning a home creates equity over time, providing financial stability and a valuable asset that can be passed down to future generations.